-

六扇门6123987.com点击有惊喜!

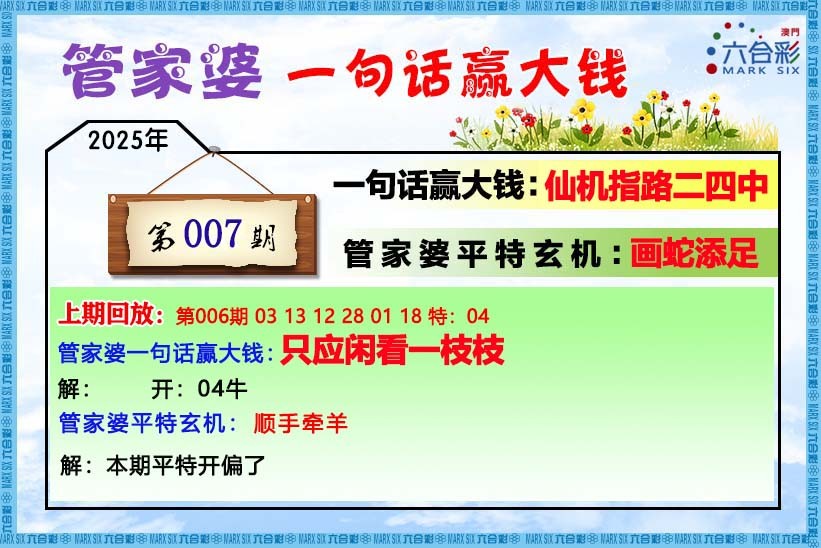

007期:必中七肖:多少买点.包您赚钱!

007期:必中五肖:重点多压

007期:必中㈢肖:稳准狠

007期:必中㈡肖:每期在这里和你相约

007期:必中㈠肖:【点击微信提前 免费领取】

007期:必中⑧码:【点击微信提前 免费领取】

-

六扇门6123987.com点击有惊喜!

006期:必中七肖:牛蛇马猴鸡猪鼠

006期:必中五肖:牛蛇马猴鸡

006期:必中㈢肖:牛蛇马

006期:必中㈡肖:牛蛇

006期:必中㈠肖:牛

006期:必中⑧码:04.28.12.47.33.32.18.41

-

六扇门6123987.com点击有惊喜!

005期:必中七肖:虎龙鸡狗猪鼠牛

005期:必中五肖:虎龙鸡狗猪

005期:必中㈢肖:虎龙鸡

005期:必中㈡肖:虎龙

005期:必中㈠肖:虎

005期:必中⑧码:03.13.08.20.42.29.28.39

-

六扇门6123987.com点击有惊喜!

004期:必中七肖:牛兔龙猴羊狗鼠

004期:必中五肖:牛兔龙猴羊

004期:必中㈢肖:牛兔龙

004期:必中㈡肖:牛兔

004期:必中㈠肖:牛

004期:必中⑧码:16.38.37.33.22.19.29.40

-

六扇门6123987.com点击有惊喜!

003期:必中七肖:蛇马猴鸡猪虎兔

003期:必中五肖:蛇马猴鸡猪

003期:必中㈢肖:蛇马猴

003期:必中㈡肖:蛇马

003期:必中㈠肖:蛇

003期:必中⑧码:12.3533.44.30.15.38.47

-

六扇门6123987.com点击有惊喜!

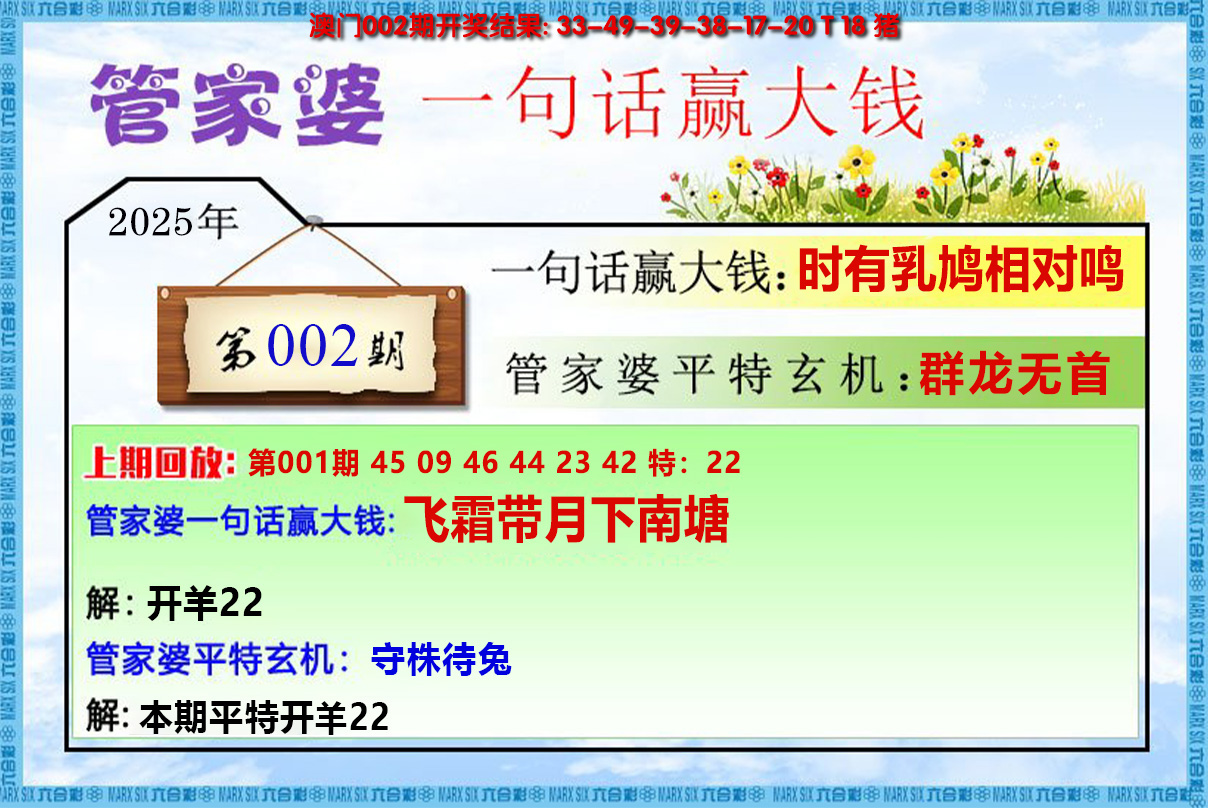

002期:必中七肖:虎龙蛇马猴鸡鼠

002期:必中五肖:虎龙蛇马猴

002期:必中㈢肖:虎龙蛇

002期:必中㈡肖:虎龙

002期:必中㈠肖:虎

002期:必中⑧码:15.37.24.35.09.44.29.39

-

六扇门6123987.com点击有惊喜!

001期:必中七肖:牛兔蛇羊猴狗鼠

001期:必中五肖:牛兔蛇羊猴

001期:必中㈢肖:牛兔蛇

001期:必中㈡肖:牛兔

001期:必中㈠肖:牛

001期:必中⑧码:28.38.1222.45.19.41.05

-

六扇门6123987.com点击有惊喜!

366期:必中七肖:鸡猪牛龙蛇羊鼠

366期:必中五肖:鸡猪牛龙蛇

366期:必中㈢肖:鸡猪牛

366期:必中㈡肖:鸡猪

366期:必中㈠肖:鸡

366期:必中⑧码:20.06.04.37.48.22.41.44

-

六扇门6123987.com点击有惊喜!

365期:必中七肖:兔狗猪牛虎马猴

365期:必中五肖:兔狗猪牛虎

365期:必中㈢肖:兔狗猪

365期:必中㈡肖:兔狗

365期:必中㈠肖:兔

365期:必中⑧码:26.19.30.28.39.47.09.02

-

六扇门6123987.com点击有惊喜!

364期:必中七肖:龙蛇马鸡猪牛兔

364期:必中五肖:龙蛇马鸡猪

364期:必中㈢肖:龙蛇马

364期:必中㈡肖:龙蛇

364期:必中㈠肖:龙

364期:必中⑧码:37.01.48.23.20.06.40.14

-

六扇门6123987.com点击有惊喜!

363期:必中七肖:鼠牛兔蛇猴羊猪

363期:必中五肖:鼠牛兔蛇猴

363期:必中㈢肖:鼠牛兔

363期:必中㈡肖:鼠牛

363期:必中㈠肖:鼠

363期:必中⑧码:17.04.26.48.09.22.18.41

-

六扇门6123987.com点击有惊喜!

362期:必中七肖:猴蛇鼠兔马龙羊

362期:必中五肖:猴蛇鼠兔马

362期:必中㈢肖:猴蛇鼠

362期:必中㈡肖:猴蛇

362期:必中㈠肖:猴

362期:必中⑧码:21.45.36.17.14.47.25.46

-

六扇门6123987.com点击有惊喜!

361期:必中七肖:狗蛇马羊鸡牛虎

361期:必中五肖:狗蛇马羊鸡

361期:必中㈢肖:狗蛇马

361期:必中㈡肖:狗蛇

361期:必中㈠肖:狗

361期:必中⑧码:07.36.47.10.20.40.03.31

-

六扇门6123987.com点击有惊喜!

360期:必中七肖:兔狗鼠蛇羊龙猪

360期:必中五肖:兔狗鼠蛇羊

360期:必中㈢肖:兔狗鼠

360期:必中㈡肖:兔狗

360期:必中㈠肖:兔

360期:必中⑧码:38.14.43.17.12.46.13.06

-

六扇门6123987.com点击有惊喜!

359期:必中七肖:鼠虎龙马猴鸡狗

359期:必中五肖:鼠虎龙马猴

359期:必中㈢肖:鼠虎龙

359期:必中㈡肖:鼠虎

359期:必中㈠肖:鼠

359期:必中⑧码:05.29.15.37.23.45.20.19

-

六扇门6123987.com点击有惊喜!

358期:必中七肖:牛兔蛇马狗猴鼠

358期:必中五肖:牛兔蛇马狗

358期:必中㈢肖:牛兔蛇

358期:必中㈡肖:牛兔

358期:必中㈠肖:牛

358期:必中⑧码:04.02.26.36.11.32.21.41

-

六扇门6123987.com点击有惊喜!

357期:必中七肖:猴牛兔蛇马鸡狗

357期:必中五肖:猴牛兔蛇马

357期:必中㈢肖:猴牛兔

357期:必中㈡肖:猴牛

357期:必中㈠肖:猴

357期:必中⑧码:21.40.14.36.47.08.31.16

-

六扇门6123987.com点击有惊喜!

356期:必中七肖:猪鼠蛇羊猴鸡狗

356期:必中五肖:猪鼠蛇羊猴

356期:必中㈢肖:猪鼠蛇

356期:必中㈡肖:猪鼠

356期:必中㈠肖:猪

356期:必中⑧码:06.29.26.46.44.20.07.42

-

六扇门6123987.com点击有惊喜!

355期:必中七肖:牛龙马猴鸡猪兔

355期:必中五肖:牛龙马猴鸡

355期:必中㈢肖:牛龙马

355期:必中㈡肖:牛龙

355期:必中㈠肖:牛

355期:必中⑧码:04.49.35.21.44.07.15.28

-

六扇门6123987.com点击有惊喜!

354期:必中七肖:猴猪龙蛇马羊牛

354期:必中五肖:猴猪龙蛇马羊

354期:必中㈢肖:猴猪龙

354期:必中㈡肖:猴猪

354期:必中㈠肖:猴

354期:必中⑧码:09.18.25.36.47.22.16.45

-

六扇门6123987.com点击有惊喜!

353期:必中七肖:狗马羊兔蛇鼠猴

353期:必中五肖:狗马羊兔蛇

353期:必中㈢肖:狗马羊

353期:必中㈡肖:狗马

353期:必中㈠肖:狗

353期:必中⑧码:19.47.22.38.24.05.45.43

-

六扇门6123987.com点击有惊喜!

352期:必中七肖:鼠虎羊蛇马狗猪

352期:必中五肖:鼠虎羊蛇马

352期:必中㈢肖:鼠虎羊

352期:必中㈡肖:鼠虎

352期:必中㈠肖:鼠

352期:必中⑧码:05.27.12.35.07.30.46.34

-

六扇门6123987.com点击有惊喜!

351期:必中七肖:牛龙马猴狗鼠虎

351期:必中五肖:牛龙马猴狗

351期:必中㈢肖:牛龙马

351期:必中㈡肖:牛龙

351期:必中㈠肖:牛

351期:必中⑧码:04.25.23.33.45.07.41.39

| 期数 | 三肖 | 特码 | 开奖号 | 结果 |

|---|---|---|---|---|

| 007期 | 获取资料 | 获取资料 | 获取资料 | 获取资料 |

| 006期 | 牛-蛇-羊 | 04-12-22 | 牛04 | 精准 |

| 005期 | 虎-龙-鸡 | 03-13-08 | 猴33 | 精准 |

| 004期 | 兔-龙-猴 | 26-37-33 | 猴33 | 精准 |

| 003期 | 蛇-马-猴 | 12-35-33 | 猴33 | 精准 |

| 002期 | 鼠-虎-龙 | 05-27-37 | 龙37 | 精准 |

| 001期 | 蛇羊-狗 | 12-22-31 | 羊22 | 精准 |

| 366期 | 龙-猪-狗 | 37-06-43 | 猪06 | 精准 |

| 365期 | 蛇-猴-猪 | 12-33-30 | 猪30 | 精准 |

| 364期 | 虎-龙-猴 | 15-01-21 | 龙01 | 精准 |

| 363期 | 牛-蛇-狗 | 04-24-43 | 牛04 | 精准 |

| 362期 | 兔-猪-蛇 | 02-30-24 | 兔02 | 精准 |

| 361期 | 兔-羊鸡 | 26-46-20 | 鸡20 | 精准 |

| 360期 | 狗-兔-蛇 | 43-14-36 | 兔14 | 精准 |

| 359期 | 虎-羊-鸡 | 15-22-44 | 虎15 | 精准 |

| 358期 | 兔-猴-狗 | 38-21-24 | 猴21 | 精准 |

| 357期 | 猴-猪-蛇 | 09-42-24 | 猴09 | 精准 |

| 356期 | 虎-蛇-羊 | 27-24-46 | 羊46 | 精准 |

| 355期 | 龙-马-猴 | 49-11-45 | 龙49 | 精准 |

| 354期 | 羊-龙-鸡 | 46-25-20 | 龙25 | 精准 |

-

007期家野中特【更新】特开:?00准

-

006期家野中特【家禽】特开:牛04准

-

005期家野中特【家禽】特开:鸡08准

-

004期家野中特【野兽】特开:猴33准

-

003期家野中特【野兽】特开:猴33准

-

002期家野中特【野兽】特开:龙37准

-

001期家野中特【家禽】特开:羊22准

-

366期家野中特【家禽】特开:猪06准

-

365期家野中特【家禽】特开:猪30准

-

364期家野中特【野兽】特开:龙01准

-

363期家野中特【家禽】特开:牛04准

-

362期家野中特【野兽】特开:兔02准

-

361期家野中特【家禽】特开:鸡20准

-

360期家野中特【野兽】特开:兔14准

-

359期家野中特【野兽】特开:虎15准

-

358期家野中特【野兽】特开:猴21准

-

357期家野中特【野兽】特开:猴09准

-

356期家野中特【家禽】特开:羊46准

-

355期家野中特【野兽】特开:龙49准

-

354期家野中特【野兽】特开:龙25准

-

353期家野中特【家禽】特开:马47准

-

352期家野中特【家禽】特开:羊10准

-

351期家野中特【野兽】特开:虎27准

-

350期家野中特【家禽】特开:牛04准

-

349期家野中特【野兽】特开:龙01准

-

348期家野中特【野兽】特开:鼠17准

-

347期家野中特【家禽】特开:牛28准

-

346期家野中特【野兽】特开:鼠41准

-

007期:双波中特【正在】【更新】开?00中

-

006期:双波中特【蓝波】【绿波】开牛04中

-

005期:双波中特【红波】【蓝波】开鸡08中

-

004期:双波中特【红波】【绿波】开猴33中

-

003期:双波中特【蓝波】【绿波】开猴33中

-

002期:双波中特【红波】【蓝波】开龙37中

-

001期:双波中特【红波】【绿波】开羊22中

-

366期:双波中特【蓝波】【绿波】开猪06中

-

365期:双波中特【红波】【蓝波】开猪30中

-

364期:双波中特【红波】【绿波】开龙01中

-

363期:双波中特【红波】【蓝波】开牛04中

-

362期:双波中特【红波】【绿波】开兔02中

-

361期:双波中特【红波】【蓝波】开鸡20中

-

360期:双波中特【蓝波】【绿波】开兔14中

-

359期:双波中特【蓝波】【红波】开虎15中

-

358期:双波中特【红波】【绿波】开猴21中

-

357期:双波中特【蓝波】【绿波】开猴09中

-

356期:双波中特【红波】【蓝波】开羊46中

-

355期:双波中特【红波】【绿波】开龙49中

-

354期:双波中特【蓝波】【红波】开龙25中

-

353期:双波中特【绿波】【蓝波】开马47中

-

352期:双波中特【蓝波】【红波】开羊10中

-

351期:双波中特【红波】【绿波】开虎27中

-

350期:双波中特【红波】【蓝波】开牛04中

-

349期:双波中特【蓝波】【红波】开龙01中

-

007期:六肖中特(资料开奖日更新)开?00中

-

006期:六肖中特(牛兔龙蛇狗猪)开牛04中

-

005期:六肖中特(虎龙鸡狗猪鼠)开鸡08中

-

004期:六肖中特(牛兔龙猴羊狗)开猴33中

-

003期:六肖中特(兔龙马猴鸡牛)开猴33中

-

002期:六肖中特(鼠虎龙马鸡猪)开龙37中

-

001期:六肖中特(龙蛇羊猴狗猪)开羊22中

-

366期:六肖中特(鼠牛龙蛇猴猪)开猪06中

-

365期:六肖中特(兔蛇羊狗猪牛)开猪30中

-

364期:六肖中特(牛虎龙马猴狗)开龙01中

-

363期:六肖中特(牛虎龙鸡马狗)开牛04中

-

362期:六肖中特(牛兔龙马猴狗)开兔02中

-

361期:六肖中特(牛兔龙猴鸡狗)开鸡20中

-

360期:六肖中特(鼠虎兔龙蛇猪)开兔14中

-

359期:六肖中特(虎龙羊鸡猪鼠)开虎15中

-

358期:六肖中特(牛兔马猴狗鼠)开猴21中

-

357期:六肖中特(猴狗虎马龙蛇)开猴09中

-

356期:六肖中特(猪鼠兔马羊鸡)开羊46中

-

355期:六肖中特(牛龙马猴鸡猪)开龙49中

-

354期:六肖中特(鼠虎龙马鸡猪)开龙25中

-

353期:六肖中特(牛兔龙马猴狗)开马47中

-

352期:六肖中特(羊猪牛虎龙马)开羊10中

-

351期:六肖中特(牛虎龙猴羊鸡)开虎27中

-

349期:六肖中特(龙兔虎狗马蛇)开龙01中

-

348期:六肖中特(马蛇龙兔虎鼠)开鼠17中

-

346期:六肖中特(羊猪马鼠蛇狗)开鼠41中

-

344期:六肖中特(兔虎鼠狗猴蛇)开兔02中

-

342期:六肖中特(龙兔虎鼠猴蛇)开龙49中

-

341期:六肖中特(猪狗鸡猴羊马)开猪18中

-

340期:六肖中特(牛猪狗鸡羊马)开马47中

-

339期:六肖中特(龙兔虎鼠羊马)开兔38中

-

337期:六肖中特(龙兔虎鼠猪蛇)开蛇48中

-

007期:琴棋书画(更新中)开?00中

-

006期:琴棋书画(棋书画)开牛04中

-

005期:琴棋书画(琴书画)开鸡08中

-

004期:琴棋书画(棋书画)开猴33中

-

003期:琴棋书画(琴棋画)开猴33中

-

002期:琴棋书画(棋书画)开龙37中

-

001期:琴棋书画(琴书画)开羊22中

-

366期:琴棋书画(棋书画)开猪06中

-

365期:琴棋书画(琴书画)开猪30中

-

364期:琴棋书画(琴棋书)开龙01中

-

363期:琴棋书画(棋书画)开牛04中

-

362期:琴棋书画(琴棋书)开兔02中

-

361期:琴棋书画(琴书画)开鸡20中

-

360期:琴棋书画(琴棋画)开兔14中

-

359期:琴棋书画(棋书画)开虎15中

-

358期:琴棋书画(琴棋画)开猴21中

-

357期:琴棋书画(琴书画)开猴09中

-

356期:琴棋书画(琴书画)开羊46中

-

355期:琴棋书画(棋琴书)开龙49中

-

354期:琴棋书画(棋书画)开龙25中

-

353期:琴棋书画(琴棋书)开马47中

-

352期:琴棋书画(琴书画)开羊10中

-

351期:琴棋书画(琴棋书)开虎27中

-

350期:琴棋书画(棋书画)开牛04中

-

琴:【兔蛇鸡】

棋:【鼠牛狗】

书:【虎龙马】

画:【羊猴猪】

-

天=兔马猴猪牛龙

地=蛇羊鸡狗鼠虎

-

007期【正在更新】特开:?00准

-

006期【天肖天肖】特开:牛04准

-

005期【地肖地肖】特开:鸡08准

-

004期【天肖天肖】特开:猴33准

-

003期【天肖天肖】特开:猴33准

-

002期【天肖天肖】特开:龙37准

-

001期【地肖地肖】特开:羊22准

-

366期【天肖天肖】特开:猪06准

-

365期【天肖天肖】特开:猪30准

-

364期【天肖天肖】特开:龙01准

-

363期【天肖天肖】特开:牛04准

-

362期【天肖天肖】特开:兔02准

-

361期【地肖地肖】特开:鸡20准

-

360期【天肖天肖】特开:兔14准

-

359期【地肖地肖】特开:虎15准

-

358期【天肖天肖】特开:猴21准

-

357期【天肖天肖】特开:猴09准

-

356期【地肖地肖】特开:羊46准

-

355期【天肖天肖】特开:龙49准

-

354期【天肖天肖】特开:龙25准

-

353期【天肖天肖】特开:马47准

-

352期【地肖地肖】特开:羊10准

-

351期【地肖地肖】特开:虎27准

-

349期【天肖天肖】特开:龙01准

-

347期【天肖天肖】特开:牛28准

-

345期【地肖地肖】特开:羊46准

-

007期:春夏秋冬(更新中)开?00中

-

006期:春夏秋冬(夏秋冬)开牛04中

-

005期:春夏秋冬(春夏秋)开鸡08中

-

004期:春夏秋冬(夏秋冬)开猴33中

-

003期:春夏秋冬(春秋冬)开猴33中

-

002期:春夏秋冬(春夏秋)开龙37中

-

001期:春夏秋冬(夏秋冬)开羊22中

-

366期:春夏秋冬(春夏冬)开猪06中

-

365期:春夏秋冬(春秋冬)开猪30中

-

364期:春夏秋冬(春夏冬)开龙01中

-

363期:春夏秋冬(夏秋冬)开牛04中

-

362期:春夏秋冬(春夏冬)开兔02中

-

361期:春夏秋冬(春秋冬)开鸡20中

-

360期:春夏秋冬(春夏秋)开兔14中

-

359期:春夏秋冬(春秋冬)开虎15中

-

358期:春夏秋冬(夏秋冬)开猴21中

-

357期:春夏秋冬(春夏秋)开猴09中

-

356期:春夏秋冬(春夏秋)开羊46中

-

355期:春夏秋冬(春夏秋)开龙49中

-

354期:春夏秋冬(春夏冬)开龙25中

-

353期:春夏秋冬(夏秋冬)开马47中

-

352期:春夏秋冬(春夏冬)开羊10中

-

351期:春夏秋冬(春秋冬)开虎27中

-

349期:春夏秋冬(春夏秋)开龙01中

-

346期:春夏秋冬(春秋冬)开鼠41中

-

345期:春夏秋冬(夏秋冬)开羊46中

-

344期:春夏秋冬(春夏秋)开兔02中

-

343期:春夏秋冬(春秋冬)开猴45中

-

342期:春夏秋冬(春夏秋)开龙49中

-

341期:春夏秋冬(春秋冬)开猪18中

-

340期:春夏秋冬(夏秋冬)开马47中

-

【春】兔、虎、龙

【夏】马、蛇、羊

【秋】鸡、猴、狗

【冬】鼠、猪、牛

-

九肖6123987.com这个网站不错开:?00准

-

八肖六扇门论坛开:?00准

-

六肖想提前看资料请加微信开:?00准

-

五肖开:?00准

-

四肖开:?00准

-

三肖开:?00准

-

二肖加微信免费领取资料开:?00准

-

一肖跟本站,迟早开路虎开:?00准

-

①码每期在这里和你相约开:?00准

-

③码每期在这里和你相约开:?00准

-

⑤码

每期在这里和你相约

开:?00准 -

⑩码每期在这里和你相约开:?00准

-

九肖兔狗马虎龙蛇羊牛鼠开:龙01准

-

八肖兔狗马虎龙蛇羊牛开:龙01准

-

六肖兔狗马虎龙蛇开:龙01准

-

五肖兔狗马虎龙开:龙01准

-

四肖兔狗马虎开:龙01准

-

三肖兔狗马开:龙01准

-

二肖兔狗开:龙01准

-

一肖兔开:龙01准

-

①码26开:龙01准

-

③码26.31.11开:龙01准

-

⑤码

26.31.11.15.01

开:龙01准 -

⑩码26.31.11.15.01

36.10.16.29.14

开:龙01准

-

九肖蛇马猴龙兔狗虎鼠牛开:鼠17准

-

八肖蛇马猴龙兔狗虎鼠开:鼠17准

-

六肖蛇马猴龙兔狗开:鼠17准

-

五肖蛇马猴龙兔开:鼠17准

-

四肖蛇马猴龙开:鼠17准

-

三肖蛇马猴开:鼠17准

-

二肖蛇马开:鼠17准

-

一肖蛇开:鼠17准

-

①码24开:鼠17准

-

③码24.23.09开:鼠17准

-

⑤码

24.23.09.01.14

开:鼠17准 -

⑩码24.23.09.01.14

31.15.17.16.36

开:鼠17准

-

九肖兔牛狗猪蛇虎羊鸡鼠开:牛28准

-

八肖兔牛狗猪蛇虎羊鸡开:牛28准

-

六肖兔牛狗猪蛇虎开:牛28准

-

五肖兔牛狗猪蛇开:牛28准

-

四肖兔牛狗猪开:牛28准

-

三肖兔牛狗开:牛28准

-

二肖兔牛开:牛28准

-

一肖兔开:牛28准

-

①码14开:牛28准

-

③码14.04.07开:牛28准

-

⑤码

14.04.07.18.12

开:牛28准 -

⑩码14.04.07.18.12

15.10.08.29.26

开:牛28准

-

九肖鼠猪马蛇鸡猴羊狗牛开:鼠41准

-

八肖鼠猪马蛇鸡猴羊狗开:鼠41准

-

六肖鼠猪马蛇鸡猴开:鼠41准

-

五肖鼠猪马蛇鸡开:鼠41准

-

四肖鼠猪马蛇开:鼠41准

-

三肖鼠猪马开:鼠41准

-

二肖鼠猪开:鼠41准

-

一肖鼠开:鼠41准

-

①码17开:鼠41准

-

③码17.30.11开:鼠41准

-

⑤码

17.30.11.24.08

开:鼠41准 -

⑩码17.30.11.24.08

21.10.43.28.29

开:鼠41准

-

九肖兔马虎狗蛇鸡羊龙猴开:兔02准

-

八肖兔马虎狗蛇鸡羊龙开:兔02准

-

六肖兔马虎狗蛇鸡开:兔02准

-

五肖兔马虎狗蛇开:兔02准

-

四肖兔马虎狗开:兔02准

-

三肖兔马虎开:兔02准

-

二肖兔马开:兔02准

-

一肖兔开:兔02准

-

①码26开:兔02准

-

③码26.35.39开:兔02准

-

⑤码

26.35.39.19.48

开:兔02准 -

⑩码26.35.39.19.48

08.34.13.33.38

开:兔02准

-

九肖龙猴虎兔狗蛇牛猪鼠开:龙49准

-

八肖龙猴虎兔狗蛇牛猪开:龙49准

-

六肖龙猴虎兔狗蛇开:龙49准

-

五肖龙猴虎兔狗开:龙49准

-

四肖龙猴虎兔开:龙49准

-

三肖龙猴虎开:龙49准

-

二肖龙猴开:龙49准

-

一肖龙开:龙49准

-

①码37开:龙49准

-

③码37.27.33开:龙49准

-

⑤码

37.27.33.26.31

开:龙49准 -

⑩码37.27.33.26.31

36.28.30.17.39

开:龙49准

-

九肖狗羊猪猴鸡蛇鼠马牛开:猪18准

-

八肖狗羊猪猴鸡蛇鼠马开:猪18准

-

六肖狗羊猪猴鸡蛇开:猪18准

-

五肖狗羊猪猴鸡开:猪18准

-

四肖狗羊猪猴开:猪18准

-

三肖狗羊猪开:猪18准

-

二肖狗羊开:猪18准

-

一肖狗开:猪18准

-

①码19开:猪18准

-

③码19.46.30开:猪18准

-

⑤码

19.46.30.33.08

开:猪18准 -

⑩码19.46.30.33.08

12.29.47.04.07

开:猪18准

-

九肖狗猪马牛鸡羊龙虎猴开:马47准

-

八肖狗猪马牛鸡羊龙虎开:马47准

-

六肖狗猪马牛鸡羊开:马47准

-

五肖狗猪马牛鸡开:马47准

-

四肖狗猪马牛开:马47准

-

三肖狗猪马开:马47准

-

二肖狗猪开:马47准

-

一肖狗开:马47准

-

①码07开:马47准

-

③码07.18.35开:马47准

-

⑤码

07.18.35.40.20

开:马47准 -

⑩码07.18.35.40.20

46.01.15.45.31

开:马47准

-

九肖兔鼠虎羊龙狗马猪牛开:兔38准

-

八肖兔鼠虎羊龙狗马猪开:兔38准

-

六肖兔鼠虎羊龙狗开:兔38准

-

五肖兔鼠虎羊龙开:兔38准

-

四肖兔鼠虎羊开:兔38准

-

三肖兔鼠虎开:兔38准

-

二肖兔鼠开:兔38准

-

一肖兔开:兔38准

-

①码02开:兔38准

-

③码02.05.39开:兔38准

-

⑤码

02.05.39.10.13

开:兔38准 -

⑩码02.05.39.10.13

31.23.42.28.26

开:兔38准

-

007期:绿蓝绿肖(正在更新)开?00中

-

006期:绿蓝绿肖(绿肖蓝肖)开牛04中

-

005期:绿蓝绿肖(红肖绿肖)开鸡08中

-

004期:绿蓝绿肖(红肖蓝肖)开猴33中

-

003期:绿蓝绿肖(蓝肖绿肖)开猴33中

-

002期:绿蓝绿肖(红肖绿肖)开龙37中

-

001期:绿蓝绿肖(蓝肖绿肖)开羊22中

-

366期:绿蓝绿肖(红肖蓝肖)开猪06中

-

365期:绿蓝绿肖(蓝肖绿肖)开猪30中

-

364期:绿蓝绿肖(红肖绿肖)开龙01中

-

363期:绿蓝绿肖(蓝肖绿肖)开牛04中

-

362期:绿蓝绿肖(蓝肖红肖)开兔02中

-

361期:绿蓝绿肖(红肖绿肖)开鸡20中

-

360期:绿蓝绿肖(红肖蓝肖)开兔14中

-

359期:绿蓝绿肖(蓝肖绿肖)开虎15中

-

358期:绿蓝绿肖(红肖蓝肖)开猴21中

-

357期:绿蓝绿肖(蓝肖绿肖)开猴09中

-

356期:绿蓝绿肖(蓝肖绿肖)开羊46中

-

355期:绿蓝绿肖(红肖绿肖)开龙49中

-

354期:绿蓝绿肖(蓝肖绿肖)开龙25中

-

353期:绿蓝绿肖(红肖绿肖)开马47中

-

352期:绿蓝绿肖(绿肖红肖)开羊10中

-

351期:绿蓝绿肖(蓝肖绿肖)开虎27中

-

350期:绿蓝绿肖(蓝肖绿肖)开牛04中

-

349期:绿蓝绿肖(红肖绿肖)开龙01中

-

347期:绿蓝绿肖(红肖绿肖)开牛28中

-

346期:绿蓝绿肖(红肖蓝肖)开鼠41中

-

345期:绿蓝绿肖(红肖绿肖)开羊46中

-

红肖:马、兔、鼠、鸡

蓝肖:蛇、虎、猪、猴

绿肖:羊、龙、牛、狗

-

007期:〖更新中〗开?00准

-

006期:〖牛蛇狗〗开牛04准

-

005期:〖虎羊鸡〗开鸡08准

-

004期:〖牛龙猴〗开猴33准

-

003期:〖兔蛇猴〗开猴33准

-

002期:〖鼠兔龙〗开龙37准

-

001期:〖蛇羊猴〗开羊22准

-

366期:〖龙蛇猪〗开猪06准

-

365期:〖兔羊猪〗开猪30准

-

364期:〖虎龙猴〗开龙01准

-

363期:〖兔马牛〗开牛04准

-

362期:〖牛兔猴〗开兔02准

-

361期:〖虎羊鸡〗开鸡20准

-

360期:〖羊鼠兔〗开兔14准

-

359期:〖虎龙羊〗开虎15准

-

358期:〖兔猴狗〗开猴21准

-

357期:〖虎蛇猴〗开猴09准

-

356期:〖羊鸡牛〗开羊46准

-

355期:〖牛龙猴〗开龙49准

-

354期:〖龙羊鸡〗开龙25准

-

353期:〖龙马猪〗开马47准

-

352期:〖羊牛狗〗开羊10准

-

351期:〖马兔虎〗开虎27准

-

349期:〖兔龙马〗开龙01准

-

346期:〖鼠马猪〗开鼠41准

-

344期:〖兔马虎〗开兔02准

-

342期:〖猴鼠龙〗开龙49准

-

341期:〖猪狗羊〗开猪18准

-

339期:〖鼠虎兔〗开兔38准

-

007期:菜肉草肖(正在更新)开?00中

-

006期:菜肉草肖(肉肖草肖)开牛04中

-

005期:菜肉草肖(菜肖草肖)开鸡08中

-

004期:菜肉草肖(肉肖菜肖)开猴33中

-

003期:菜肉草肖(草肖菜肖)开猴33中

-

002期:菜肉草肖(肉肖菜肖)开龙37中

-

001期:菜肉草肖(菜肖草肖)开羊22中

-

366期:菜肉草肖(肉肖菜肖)开猪06中

-

365期:菜肉草肖(菜肖草肖)开猪30中

-

364期:菜肉草肖(肉肖草肖)开龙01中

-

363期:菜肉草肖(菜肖草肖)开牛04中

-

362期:菜肉草肖(肉肖草肖)开兔02中

-

361期:菜肉草肖(肉肖菜肖)开鸡20中

-

360期:菜肉草肖(菜肖草肖)开兔14中

-

359期:菜肉草肖(肉肖草肖)开虎15中

-

358期:菜肉草肖(菜肖肉肖)开猴21中

-

357期:菜肉草肖(菜肖草肖)开猴09中

-

356期:菜肉草肖(肉肖草肖)开羊46中

-

355期:菜肉草肖(菜肖肉肖)开龙49中

-

354期:菜肉草肖(肉肖草肖)开龙25中

-

353期:菜肉草肖(菜肖草肖)开马47中

-

352期:菜肉草肖(肉肖草肖)开羊10中

-

351期:菜肉草肖(菜肖肉肖)开虎27中

-

350期:菜肉草肖(肉肖草肖)开牛04中

-

349期:菜肉草肖(肉肖草肖)开龙01中

-

347期:菜肉草肖(菜肖草肖)开牛28中

-

346期:菜肉草肖(菜肖草肖)开鼠41中

-

345期:菜肉草肖(肉肖草肖)开羊46中

-

344期:菜肉草肖(草肖肉肖)开兔02中

-

342期:菜肉草肖(肉肖菜肖)开龙49中

-

341期:菜肉草肖(菜肖草肖)开猪18中

-

肉肖:虎蛇龙狗

菜肖:猪鼠鸡猴

草肖:牛羊马兔

-

007期:男女中特【正在】【更新】开猫00中

-

006期:男女中特【男肖】【男肖】开牛04中

-

005期:男女中特【女肖】【女肖】开鸡08中

-

004期:男女中特【男肖】【男肖】开猴33中

-

003期:男女中特【男肖】【男肖】开猴33中

-

002期:男女中特【男肖】【男肖】开龙37中

-

001期:男女中特【女肖】【女肖】开羊22中

-

366期:男女中特【女肖】【女肖】开猪06中

-

365期:男女中特【女肖】【女肖】开猪30中

-

364期:男女中特【男肖】【男肖】开龙01中

-

363期:男女中特【男肖】【男肖】开牛04中

-

362期:男女中特【女肖】【女肖】开兔02中

-

361期:男女中特【女肖】【女肖】开鸡20中

-

360期:男女中特【女肖】【女肖】开兔14中

-

359期:男女中特【男肖】【男肖】开虎15中

-

358期:男女中特【男肖】【男肖】开猴21中

-

357期:男女中特【男肖】【男肖】开猴09中

-

356期:男女中特【女肖】【女肖】开羊46中

-

355期:男女中特【男肖】【男肖】开龙49中

-

354期:男女中特【男肖】【男肖】开龙25中

-

353期:男女中特【男肖】【男肖】开马47中

-

352期:男女中特【女肖】【女肖】开羊10中

-

351期:男女中特【男肖】【男肖】开虎27中

-

女肖:兔蛇羊鸡猪

男肖:鼠牛虎龙马猴狗

-

007期:六扇门平特(更新中)开00中

-

006期:六扇门平特(猪猪猪)开18中

-

005期:六扇门平特(虎虎虎)开03中

-

004期:六扇门平特(狗狗狗)开07中

-

003期:六扇门平特(马马马)开47中

-

002期:六扇门平特(牛牛牛)开04中

-

001期:六扇门平特(猪猪猪)开18中

-

366期:六扇门平特(蛇蛇蛇)开24中

-

365期:六扇门平特(鼠鼠鼠)开05中

-

364期:六扇门平特(虎虎虎)开15中

-

363期:六扇门平特(蛇蛇蛇)开36中

-

362期:六扇门平特(鼠鼠鼠)开05中

-

361期:六扇门平特(羊羊羊)开22中

-

360期:六扇门平特(马马马)开35中

-

359期:六扇门平特(兔兔兔)开02中

-

358期:六扇门平特(狗狗狗)开19中

-

357期:六扇门平特(牛牛牛)开16中

-

356期:六扇门平特(狗狗狗)开43中

-

355期:六扇门平特(猴猴猴)开09中

-

354期:六扇门平特(猪猪猪)开06中

-

353期:六扇门平特(牛牛牛)开40中

-

352期:六扇门平特(猴猴猴)开09中

-

351期:六扇门平特(羊羊羊)开22中

-

349期:六扇门平特(龙龙龙)开01中

-

007期:一行中特(金)防(木水土)开?00中

-

006期:一行中特(金)防(木水土)开牛04中

-

005期:一行中特(金)防(木火土)开鸡08中

-

004期:一行中特(金)防(水火土)开猴33中

-

003期:一行中特(金)防(木水火)开猴33中

-

002期:一行中特(金)防(木火土)开龙37中

-

001期:一行中特(金)防(木水火)开羊22中

-

366期:一行中特(金)防(木水土)开猪06中

-

365期:一行中特(金)防(木水火)开猪30中

-

364期:一行中特(金)防(水火土)开龙01中

-

363期:一行中特(金)防(木水土)开牛04中

-

362期:一行中特(金)防(火水土)开兔02中

-

361期:一行中特(金)防(木水土)开鸡20中

-

360期:一行中特(金)防(木火土)开兔14中

-

359期:一行中特(金)防(木水火)开虎15中

-

358期:一行中特(金)防(木水土)开猴21中

-

357期:一行中特(金)防(木水火)开猴09中

-

356期:一行中特(金)防(木火土)开羊46中

-

355期:一行中特(金)防(木水土)开龙49中

-

354期:一行中特(金)防(木火土)开龙25中

-

353期:一行中特(金)防(水火土)开马47中

-

352期:一行中特(金)防(木火土)开羊10中

-

351期:一行中特(金)防(木火土)开虎27中

-

349期:一行中特(金)防(木水火)开龙01中

-

348期:一行中特(金)防(木火土)开鼠17中

-

347期:一行中特(金)防(木水火)开牛28中

-

346期:一行中特(金)防(水火土)开鼠41中

-

345期:一行中特(金)防(木水火)开羊46中

-

344期:一行中特(金)防(水火木)开兔02中

-

343期:一行中特(金)防(木水火)开猴45中

-

340期:一行中特(金)防(水土火)开马47中

-

339期:一行中特(金)防(水火土)开兔38中

-

338期:一行中特(金)防(水木土)开牛40中

-

【金】:02 03 10 11 24 25 32 33 40 41

【木】:06 07 14 15 22 23 36 37 44 45

【水】:12 13 20 21 28 29 42 43

【火】:01 08 09 16 17 30 31 38 39 46 47

【土】:04 05 18 19 26 27 34 35 48 49

-

007期杀特三肖[更新中]开?00中

-

006期杀特三肖[虎马猴]开牛04中

-

005期杀特三肖[兔马猴]开鸡08中

-

004期杀特三肖[蛇马鸡]开猴33中

-

003期杀特三肖[鼠羊狗]开猴33中

-

002期杀特三肖[牛羊狗]开龙37中

-

001期杀特三肖[鼠虎马]开羊22中

-

366期杀特三肖[虎兔马]开猪06中

-

365期杀特三肖[虎龙鸡]开猪30中

-

364期杀特三肖[鼠兔羊]开龙01中

-

363期杀特三肖[龙蛇鸡]开牛04中

-

362期杀特三肖[虎马鸡]开兔02中

-

361期杀特三肖[鼠龙马]开鸡20中

-

360期杀特三肖[牛虎鸡]开兔14中

-

359期杀特三肖[兔蛇鸡]开虎15中

-

358期杀特三肖[虎龙鸡]开猴21中

-

357期杀特三肖[鼠龙羊]开猴09中

-

356期杀特三肖[虎龙马]开羊46中

-

355期杀特三肖[蛇羊狗]开龙49中

-

354期杀特三肖[虎羊猪]开龙25中

-

353期杀特三肖[牛兔羊]开马47中

-

352期杀特三肖[鼠兔狗]开羊10中

-

351期杀特三肖[兔狗马]开虎27中

-

349期杀特三肖[鼠鸡猴]开龙01中

-

348期杀特三肖[羊牛鸡]开鼠17中

-

347期杀特三肖[鼠猴马]开牛28中

-

346期杀特三肖[兔龙虎]开鼠41中

-

345期杀特三肖[猴虎牛]开羊46中

-

344期杀特三肖[鼠牛猪]开兔02中

-

342期杀特三肖[猪鸡羊]开龙49中

-

341期杀特三肖[虎龙牛]开猪18中

-

007期杀特三尾[更新中]开?00中

-

006期杀特三尾[258尾]开牛04中

-

005期杀特三尾[147尾]开鸡08中

-

004期杀特三尾[027尾]开猴33中

-

003期杀特三尾[167尾]开猴33中

-

002期杀特三尾[046尾]开龙37中

-

001期杀特三尾[158尾]开羊22中

-

366期杀特三尾[124尾]开猪06中

-

365期杀特三尾[367尾]开猪30中

-

364期杀特三尾[068尾]开龙01中

-

363期杀特三尾[156尾]开牛04中

-

362期杀特三尾[358尾]开兔02中

-

361期杀特三尾[146尾]开鸡20中

-

360期杀特三尾[238尾]开兔14中

-

359期杀特三尾[148尾]开虎15中

-

358期杀特三尾[247尾]开猴21中

-

357期杀特三尾[358尾]开猴09中

-

356期杀特三尾[247尾]开羊46中

-

355期杀特三尾[135尾]开龙49中

-

354期杀特三尾[237尾]开龙25中

-

353期杀特三尾[136尾]开马47中

-

352期杀特三尾[352尾]开羊10中

-

351期杀特三尾[128尾]开虎27中

-

350期杀特三尾[157尾]开牛04中

-

349期杀特三尾[074尾]开龙01中

-

348期杀特三尾[018尾]开鼠17中

-

347期杀特三尾[012尾]开牛28中

-

346期杀特三尾[048尾]开鼠41中

-

345期杀特半波[蓝单]开羊46中

-

346期杀特半波[绿双]开鼠41中

-

347期杀特半波[红双]开牛28中

-

348期杀特半波[红双]开鼠17中

-

349期杀特半波[绿单]开龙01中

-

350期杀特半波[绿单]开牛04中

-

351期杀特半波[蓝双]开虎27中

-

352期杀特半波[绿单]开羊10中

-

353期杀特半波[红双]开马47中

-

354期杀特半波[绿双]开龙25中

-

355期杀特半波[红双]开龙49中

-

356期杀特半波[蓝单]开羊46中

-

357期杀特半波[红双]开猴09中

-

358期杀特半波[蓝双]开猴21中

-

359期杀特半波[绿双]开虎15中

-

360期杀特半波[红单]开兔14中

-

361期杀特半波[绿单]开鸡20中

-

362期杀特半波[蓝单]开兔02中

-

363期杀特半波[红单]开牛04中

-

364期杀特半波[绿双]开龙01中

-

365期杀特半波[蓝单]开猪30中

-

366期杀特半波[红双]开猪06中

-

001期杀特半波[蓝单]开羊22中

-

002期杀特半波[红双]开龙37中

-

003期杀特半波[蓝双]开猴33中

-

004期杀特半波[红双]开猴33中

-

005期杀特半波[绿单]开鸡08中

-

006期杀特半波[红单]开牛04中

-

007期杀特半波[更新]开?00中

- 精品四不像

- 澳门挂牌

- 澳门跑狗图

- 九肖十码

- 女人味

- 美人鱼

- 澳门春宫圖

- 澳门跑马图

- 正版蛇蛋图

- 凤凰天机图

- 澳门傳眞

- 龙门客栈

- 男人味

- 澳门红虎

- 澳門内幕

- 相入非非

- 石獅镇碼

- 每日闲情

- 幽默猜测

- 功夫早茶

- 一句真言

- 周公解梦

- 趣味幽默

- 老版跑狗

- 特码诗句

- 另版跑狗

- 番薯真人

- 金钱豹A

- 澳彩签牌

- 值日生肖

- 通天报社

- 奥彩专用

- 奥客家娘

- 财神报A

- 银财神报

- 财神报B

- 金财神报

- 请财神报

- 蓝财神报

- 平财神报

- 财神报C

- 绿财神报

- 波贴天机

- 独解传真

- 澳门马票

- 金钱豹B

- 早茶论码

- 拾贰地支

- 妈祖显灵

- 六合神童

- 皇道吉日

- 澳门西游

- 玄机秘贴

- 正版射牌

- 平特一肖

- 凤凰卜卦

- 钟馗大神

- 正版诗象

- 心水彩报

- 青龙精解

- 宝马彩报

- 澳门日报

- 澳门信封

- 白狼经典

- 小幽默之

- 澳彩图库

- 秘典玄机

- 六合内幕

- 六合典家

- 财神特码

- 财童送宝

- 财童送码

- 内幕玄機

- 博彩特利

- 六合雄霸

- 龍騰豹變

- 内幕选馬

- 馬會追踪

- 馬會追踪

- 妈祖献宝

- 奇准无比

- 猪哥报

- 六合英雄

- 六合黑庄

- 急智金囊

- 香港挂牌

- 大富翁

- 神鸟版

- 发财献策

- 马经霸王

- 诸葛神算

- 发财波局

- 识破玄机

- 狗头报

- 蜗牛报

- 独一无二

- 会员料

- 玄学代码

- 五星报B

- 神算策略

- 大话特码

- 铁算盘

- 广东赌王

- 观音心经

- 六合飞鸽

- 藏宝图

- 精品报

- 天尊报

- 洋通报

- 特码图

- 天机报

- 内幕报

- 马会图

- 九龙密报

- 小贴士A

- 湖南码报

- 莲花报

- 九龙精解

- 三元神算

- 经典尾报

- 经典单双

- 不服来战

- 新大富翁

- 发财秘诀

- 红灯笼

- 码头诗

- 六合头条

- 蓝财神

- 电邮天地

- 女财神报

- 东南漫画

- 金元宝

- 赚客报

- 新粤彩4

- 天眼神算

- 香港挂牌

- 正手写A

- 白姐泄密

- 精锐报

- 一样发

- 五福临门

- 佛祖救世

- 内幕赌经

- 福星报

- 心水特码

- 孔明报

- 蛇报A

- 旺角菜报

- 三合皇

- 一封信

- 点将单

- 水果报

-

2024龙年(十二生肖号码对照)鼠

[冲马]

05172941牛[冲羊]

04162840虎[冲猴]

03152739兔[冲鸡]

02142638龙[冲狗]

0113253749蛇[冲猪]

12243648马[冲鼠]

11233547羊[冲牛]

10223446猴[冲虎]

09213345鸡[冲兔]

08203244狗[冲龙]

07193143猪[冲蛇]

06183042 -

玻色参照表红波:0102070812131819232429303435404546蓝波:03040910141520252631363741424748绿波:05061116172122272832333839434449

-

五行参照表金:02031011242532334041木:06071415222336374445水:1213202128294243火:0108091617303138394647土:04051819262734354849

-

合数单双合数单:01030507091012141618212325272930323436384143454749合数双:020406081113151719202224262831333537394042444648

-

生肖属性照表家禽:牛、马、羊、鸡、狗、猪野兽:鼠、虎、兔、龙、蛇、猴吉美:兔、龙、蛇、马、羊、鸡凶丑:鼠、牛、虎、猴、狗、猪阴性:鼠、龙、蛇、马、狗、猪阳性:牛、虎、兔、羊、猴、鸡单笔:鼠、龙、马、蛇、鸡、猪双笔:虎、猴、狗、兔、羊、牛天肖:兔、马、猴、猪、牛、龙地肖:蛇、羊、鸡、狗、鼠、虎白边:鼠、牛、虎、鸡、狗、猪黑中:兔、龙、蛇、马、羊、猴女肖:兔、蛇、羊、鸡、猪(五宫肖)男肖:鼠、牛、虎、龙、马、猴、狗三合:鼠龙猴、牛蛇鸡、虎马狗、兔羊猪六合:鼠牛、龙鸡、虎猪、蛇猴、兔狗、马羊琴:兔蛇鸡棋:鼠牛狗书:虎龙马画:羊猴猪五福肖::鼠、虎、兔、蛇、猴[龙]红肖:马、兔、鼠、鸡蓝肖:蛇、虎、猪、猴绿肖:羊、龙、牛、狗

-

六扇门6123987.com点击有惊喜!

002期:必中七肖:多少买点.包您赚钱!

002期:必中五肖:重点多压

002期:必中㈢肖:稳准狠

002期:必中㈡肖:每期在这里和你相约

002期:必中㈠肖:【点击微信提前免费领取】

002期:必中⑧码:【点击微信提前免费领取】

-

六扇门6123987.com点击有惊喜!

001期:必中七肖:虎蛇马羊鸡狗鼠

001期:必中五肖:虎蛇马羊鸡

001期:必中㈢肖:虎蛇马

001期:必中㈡肖:虎蛇

001期:必中㈠肖:虎

001期:必中⑧码:40.24.11.22.32.19.41.28

-

六扇门6123987.com点击有惊喜!

140期:必中七肖:鼠虎兔蛇羊狗牛

140期:必中五肖:鼠虎兔蛇羊

140期:必中㈢肖:鼠虎兔

140期:必中㈡肖:鼠虎

140期:必中㈠肖:鼠

140期:必中⑧码:41.15.14.36.10.43.28.17

-

六扇门6123987.com点击有惊喜!

139期:必中七肖:狗鼠兔马猴羊鸡

139期:必中五肖:狗鼠兔马猴

139期:必中㈢肖:狗鼠兔

139期:必中㈡肖:狗鼠

139期:必中㈠肖:狗

139期:必中⑧码:43.41.17.38.23.33.22.32

-

六扇门6123987.com点击有惊喜!

138期:必中七肖:猴狗猪兔龙马羊

138期:必中五肖:猴狗猪兔龙

138期:必中㈢肖:猴狗猪

138期:必中㈡肖:猴狗

138期:必中㈠肖:猴

138期:必中⑧码:45.19.18.26.49.35.10.07

-

六扇门6123987.com点击有惊喜!

137期:必中七肖:羊猪虎蛇猴鸡鼠

137期:必中五肖:羊猪虎蛇猴

137期:必中㈢肖:羊猪虎

137期:必中㈡肖:羊猪

137期:必中㈠肖:羊

137期:必中⑧码:22.18.39.12.10.45.08.41

-

六扇门6123987.com点击有惊喜!

136期:必中七肖:鼠兔牛猴狗鸡马

136期:必中五肖:鼠兔牛猴狗

136期:必中㈢肖:鼠兔牛

136期:必中㈡肖:鼠兔

136期:必中㈠肖:鼠

136期:必中⑧码:29.38.22.45.31.08.23.28

-

六扇门6123987.com点击有惊喜!

135期:必中七肖:猪龙鼠兔鸡猴猪

135期:必中五肖:猪龙鼠兔鸡

135期:必中㈢肖:猪龙鼠

135期:必中㈡肖:猪龙

135期:必中㈠肖:猪

135期:必中⑧码:18.30.13.29.26.44.25.42

-

六扇门6123987.com点击有惊喜!

134期:必中七肖:牛蛇羊狗猪兔马

134期:必中五肖:牛蛇羊狗猪

134期:必中㈢肖:牛蛇羊

134期:必中㈡肖:牛蛇

134期:必中㈠肖:牛

134期:必中⑧码:16.28.24.10.07.06.23.19

-

六扇门6123987.com点击有惊喜!

133期:必中七肖:猴鼠虎牛兔蛇龙

133期:必中五肖:猴鼠虎牛兔

133期:必中㈢肖:猴鼠虎

133期:必中㈡肖:猴鼠

133期:必中㈠肖:猴

133期:必中⑧码:21.17.39.04.38.36.40.37

-

六扇门6123987.com点击有惊喜!

132期:必中七肖:羊鸡猪狗猴蛇马

132期:必中五肖:羊鸡猪狗猴

132期:必中㈢肖:羊鸡猪

132期:必中㈡肖:羊鸡

132期:必中㈠肖:羊

132期:必中⑧码:22.20.18.19.45.24.35.30

-

六扇门6123987.com点击有惊喜!

131期:必中七肖:猪牛狗马鸡羊龙

131期:必中五肖:猪牛狗马鸡

131期:必中㈢肖:猪牛狗

131期:必中㈡肖:猪牛

131期:必中㈠肖:猪

131期:必中⑧码:30.04.19.23.08.34.13.18

-

002期家野中特【更新】特开:?00准

-

001期家野中特【野兽】特开:羊22准

-

140期家野中特【野兽】特开:兔14准

-

139期家野中特【野兽】特开:猴45准

-

138期家野中特【家禽】特开:猪18准

-

137期家野中特【家禽】特开:羊10准

-

136期家野中特【家禽】特开:牛28准

-

135期家野中特【野兽】特开:兔38准

-

134期家野中特【家禽】特开:羊22准

-

133期家野中特【家禽】特开:牛04准

-

132期家野中特【家禽】特开:羊22准

-

131期家野中特【家禽】特开:羊22准

-

130期家野中特【家禽】特开:马23准

-

129期家野中特【野兽】特开:兔38准

-

128期家野中特【野兽】特开:龙01准

-

127期家野中特【家禽】特开:羊34准

-

126期家野中特【家禽】特开:马35准

-

125期家野中特【野兽】特开:蛇12准

-

124期家野中特【野兽】特开:鼠29准

-

123期家野中特【家禽】特开:马23准

-

002期:双波中特【正在】【更新】开?00中

-

001期:双波中特【红波】【绿波】开羊22中

-

140期:双波中特【绿波】【蓝波】开兔14中

-

139期:双波中特【红波】【蓝波】开猴45中

-

138期:双波中特【红波】【绿波】开猪18中

-

137期:双波中特【蓝波】【绿波】开羊10中

-

136期:双波中特【绿波】【红波】开牛28中

-

135期:双波中特【绿波】【蓝波】开兔38中

-

134期:双波中特【绿波】【红波】开羊22中

-

002期:六肖中特(资料开奖日更新)开?00中

-

001期:六肖中特(虎蛇羊猴狗猪)开羊22中

-

140期:六肖中特(虎兔龙羊鸡猪)开兔14中

-

139期:六肖中特(鼠兔龙猴狗猪)开猴45中

-

138期:六肖中特(猪牛兔马羊狗)开猪18中

-

137期:六肖中特(蛇羊鸡猪虎兔)开羊10中

-

136期:六肖中特(狗猪牛兔龙马)开牛28中

-

135期:六肖中特(兔猪虎狗马蛇)开兔38中

-

134期:六肖中特(马蛇龙兔虎羊)开羊22中

-

133期:六肖中特(羊猪马牛蛇狗)开牛04中

-

132期:六肖中特(羊虎鼠狗猴蛇)开羊22中

-

131期:六肖中特(羊兔虎鼠猴蛇)开羊22中

-

130期:六肖中特(马狗鸡猴羊猪)开马23中

-

129期:六肖中特(牛猪狗鸡羊兔)开兔38中

-

128期:六肖中特(狗龙虎鼠羊马)开龙01中

-

127期:六肖中特(龙兔虎鼠猪羊)开羊34中

-

126期:六肖中特(龙兔鸡猴马蛇)开马35中

-

125期:六肖中特(虎牛狗蛇马羊)开蛇12中

-

002期:琴棋书画(更新中)开?00中

-

001期:琴棋书画(棋书画)开羊22中

-

140期:琴棋书画(琴棋书)开兔14中

-

139期:琴棋书画(琴书画)开猴45中

-

138期:琴棋书画(琴棋画)开猪18中

-

137期:琴棋书画(琴书画)开羊10中

-

136期:琴棋书画(琴棋画)开牛28中

-

135期:琴棋书画(琴书画)开兔38中

-

134期:琴棋书画(琴棋画)开羊22中

-

133期:琴棋书画(琴棋书)开牛04中

-

132期:琴棋书画(琴画书)开羊22中

-

131期:琴棋书画(画书琴)开羊22中

-

130期:琴棋书画(琴棋书)开马23中

-

129期:琴棋书画(画棋书)开兔38中

-

128期:琴棋书画(棋画书)开龙01中

-

127期:琴棋书画(琴画书)开羊34中

-

126期:琴棋书画(棋琴书)开马35中

-

125期:琴棋书画(琴书画)开蛇12中

-

124期:琴棋书画(琴棋画)开鼠29中

-

123期:琴棋书画(琴画书)开马23中

-

122期:琴棋书画(棋书画)开猪30中

-

琴:【兔蛇鸡】

棋:【鼠牛狗】

书:【虎龙马】

画:【羊猴猪】

-

天=兔马猴猪牛龙

地=蛇羊鸡狗鼠虎

-

002期【正在更新】特开:?00准

-

001期【地肖地肖】特开:羊22准

-

140期【天肖天肖】特开:兔14准

-

139期【天肖天肖】特开:猴45准

-

138期【天肖天肖】特开:猪18准

-

137期【地肖地肖】特开:羊10准

-

136期【天肖天肖】特开:牛28准

-

135期【天肖天肖】特开:兔38准

-

134期【地肖地肖】特开:羊22准

-

133期【天肖天肖】特开:牛04准

-

132期【地肖地肖】特开:羊22准

-

131期【地肖地肖】特开:羊22准

-

130期【天肖天肖】特开:马23准

-

002期:春夏秋冬(更新中)开?00中

-

001期:春夏秋冬(夏秋冬)开羊22中

-

140期:春夏秋冬(春夏冬)开兔14中

-

139期:春夏秋冬(夏秋冬)开猴45中

-

138期:春夏秋冬(春秋冬)开猪18中

-

137期:春夏秋冬(秋夏冬)开羊10中

-

136期:春夏秋冬(春秋冬)开牛28中

-

135期:春夏秋冬(春夏秋)开兔38中

-

134期:春夏秋冬(春秋夏)开羊22中

-

133期:春夏秋冬(冬秋夏)开牛04中

-

132期:春夏秋冬(夏春秋)开羊22中

-

131期:春夏秋冬(春夏冬)开羊22中

-

130期:春夏秋冬(夏春秋)开马23中

-

129期:春夏秋冬(秋冬春)开兔38中

-

128期:春夏秋冬(春秋冬)开龙01中

-

127期:春夏秋冬(夏春秋)开羊34中

-

126期:春夏秋冬(春冬夏)开马35中

-

125期:春夏秋冬(春夏秋)开蛇12中

-

124期:春夏秋冬(春冬秋)开鼠29中

-

123期:春夏秋冬(春秋夏)开马23中

-

【春】兔、虎、龙

【夏】马、蛇、羊

【秋】鸡、猴、狗

【冬】鼠、猪、牛

-

九肖6123987.com这个网站不错开:?00准

-

八肖六扇门论坛开:?00准

-

六肖想提前看资料请加微信开:?00准

-

五肖开:?00准

-

四肖开:?00准

-

三肖开:?00准

-

二肖加微信免费领取资料开:?00准

-

一肖跟本站,迟早开路虎开:?00准

-

①码每期在这里和你相约开:?00准

-

③码每期在这里和你相约开:?00准

-

⑤码

每期在这里和你相约

开:?00准 -

⑩码每期在这里和你相约开:?00准

-

九肖龙狗马虎兔蛇羊牛鼠开:兔38准

-

八肖龙狗马虎兔蛇羊牛开:兔38准

-

六肖龙狗马虎兔蛇开:兔38准

-

五肖龙狗马虎兔开:兔38准

-

四肖龙狗马虎开:兔38准

-

三肖龙狗马开:兔38准

-

二肖龙狗开:兔38准

-

一肖龙开:兔38准

-

①码26开:兔38准

-

③码26.31.11开:兔38准

-

⑤码

26.31.11.15.38

开:兔38准 -

⑩码26.31.11.15.38

36.10.16.29.14

开:兔38准

-

九肖蛇马猴龙兔狗虎羊牛开:羊22准

-

八肖蛇马猴龙兔狗虎羊开:羊22准

-

六肖蛇马猴龙兔狗开:羊22准

-

五肖蛇马猴龙兔开:羊22准

-

四肖蛇马猴龙开:羊22准

-

三肖蛇马猴开:羊22准

-

二肖蛇马开:羊22准

-

一肖蛇开:羊22准

-

①码24开:羊22准

-

③码24.23.09开:羊22准

-

⑤码

24.23.09.01.14

开:羊22准 -

⑩码24.23.09.01.14

31.15.22.16.36

开:羊22准

-

九肖兔牛狗猪蛇虎羊鸡鼠开:牛04准

-

八肖兔牛狗猪蛇虎羊鸡开:牛04准

-

六肖兔牛狗猪蛇虎开:牛04准

-

五肖兔牛狗猪蛇开:牛04准

-

四肖兔牛狗猪开:牛04准

-

三肖兔牛狗开:牛04准

-

二肖兔牛开:牛04准

-

一肖兔开:牛04准

-

①码14开:牛04准

-

③码14.28.07开:牛04准

-

⑤码

14.28.07.18.12

开:牛04准 -

⑩码14.28.07.18.12

15.10.08.29.26

开:牛04准

-

九肖羊猪马蛇鸡猴鼠狗牛开:羊22准

-

八肖羊猪马蛇鸡猴鼠狗开:羊22准

-

六肖羊猪马蛇鸡猴开:羊22准

-

五肖羊猪马蛇鸡开:羊22准

-

四肖羊猪马蛇开:羊22准

-

三肖羊猪马开:羊22准

-

二肖羊猪开:羊22准

-

一肖羊开:羊22准

-

①码17开:羊22准

-

③码17.30.11开:羊22准

-

⑤码

17.30.11.24.08

开:羊22准 -

⑩码17.30.11.24.08

21.10.43.28.29

开:羊22准

-

九肖羊马虎狗蛇鸡兔龙猴开:羊22准

-

八肖羊马虎狗蛇鸡兔龙开:羊22准

-

六肖羊马虎狗蛇鸡开:羊22准

-

五肖羊马虎狗蛇开:羊22准

-

四肖羊马虎狗开:羊22准

-

三肖羊马虎开:羊22准

-

二肖羊马开:羊22准

-

一肖羊开:羊22准

-

①码26开:羊22准

-

③码26.35.39开:羊22准

-

⑤码

26.35.39.19.48

开:羊22准 -

⑩码26.35.39.19.48

08.34.13.33.38

开:羊22准

-

九肖马猴虎兔狗蛇牛猪鼠开:马23准

-

八肖马猴虎兔狗蛇牛猪开:马23准

-

六肖马猴虎兔狗蛇开:马23准

-

五肖马猴虎兔狗开:马23准

-

四肖马猴虎兔开:马23准

-

三肖马猴虎开:马23准

-

二肖马猴开:马23准

-

一肖马开:马23准

-

①码37开:马23准

-

③码37.27.33开:马23准

-

⑤码

37.27.33.26.31

开:马23准 -

⑩码37.27.33.26.31

36.28.30.17.39

开:马23准

-

九肖狗羊兔猴鸡蛇鼠马牛开:兔38准

-

八肖狗羊兔猴鸡蛇鼠马开:兔38准

-

六肖狗羊兔猴鸡蛇开:兔38准

-

五肖狗羊兔猴鸡开:兔38准

-

四肖狗羊兔猴开:兔38准

-

三肖狗羊兔开:兔38准

-

二肖狗羊开:兔38准

-

一肖狗开:兔38准

-

①码19开:兔38准

-

③码19.46.30开:兔38准

-

⑤码

19.46.30.33.08

开:兔38准 -

⑩码19.46.30.33.08

12.29.47.04.07

开:兔38准

-

九肖狗猪龙牛鸡羊马虎猴开:龙01准

-

八肖狗猪龙牛鸡羊马虎开:龙01准

-

六肖狗猪龙牛鸡羊开:龙01准

-

五肖狗猪龙牛鸡开:龙01准

-

四肖狗猪龙牛开:龙01准

-

三肖狗猪龙开:龙01准

-

二肖狗猪开:龙01准

-

一肖狗开:龙01准

-

①码07开:龙01准

-

③码07.18.35开:龙01准

-

⑤码

07.18.35.40.20

开:龙01准 -

⑩码07.18.35.40.20

46.01.15.45.31

开:龙01准

-

九肖羊鼠虎兔龙狗马猪牛开:羊34准

-

八肖羊鼠虎兔龙狗马猪开:羊34准

-

六肖羊鼠虎兔龙狗开:羊34准

-

五肖羊鼠虎兔龙开:羊34准

-

四肖羊鼠虎兔开:羊34准

-

三肖羊鼠虎开:羊34准

-

二肖羊鼠开:羊34准

-

一肖羊开:羊34准

-

①码02开:羊34准

-

③码02.05.39开:羊34准

-

⑤码

02.05.39.10.13

开:羊34准 -

⑩码02.05.39.10.13

31.23.42.28.26

开:羊34准

-

002期:绿蓝绿肖(正在更新)开?00中

-

001期:绿蓝绿肖(蓝肖绿肖)开羊22中

-

140期:绿蓝绿肖(红肖绿肖)开兔14中

-

139期:绿蓝绿肖(蓝肖绿肖)开猴45中

-

138期:绿蓝绿肖(红肖蓝肖)开猪18中

-

137期:绿蓝绿肖(蓝肖绿肖)开羊10中

-

136期:绿蓝绿肖(红肖绿肖)开牛28中

-

135期:绿蓝绿肖(蓝肖红肖)开兔38中

-

134期:绿蓝绿肖(红肖绿肖)开羊22中

-

133期:绿蓝绿肖(绿肖红肖)开牛04中

-

132期:绿蓝绿肖(绿肖蓝肖)开羊22中

-

131期:绿蓝绿肖(红肖绿肖)开羊22中

-

130期:绿蓝绿肖(红肖绿肖)开马23中

-

129期:绿蓝绿肖(蓝肖红肖)开兔38中

-

128期:绿蓝绿肖(绿肖蓝肖)开龙01中

-

127期:绿蓝绿肖(红肖绿肖)开羊34中

-

126期:绿蓝绿肖(红肖绿肖)开马35中

-

125期:绿蓝绿肖(蓝肖绿肖)开蛇12中

-

124期:绿蓝绿肖(蓝肖红肖)开鼠29中

-

123期:绿蓝绿肖(蓝肖红肖)开马23中

-

122期:绿蓝绿肖(红肖蓝肖)开猪30中

-

121期:绿蓝绿肖(绿肖蓝肖)开狗07中

-

120期:绿蓝绿肖(绿肖红肖)开鼠17中

-

红肖:马、兔、鼠、鸡

蓝肖:蛇、虎、猪、猴

绿肖:羊、龙、牛、狗

-

002期:〖更新中〗开?00准

-

001期:〖虎蛇羊〗开羊22准

-

140期:〖兔龙羊〗开兔14准

-

139期:〖兔羊猴〗开猴45准

-

138期:〖牛马猪〗开猪18准

-

137期:〖虎羊鸡〗开羊10准

-

136期:〖牛兔狗〗开牛28准

-

135期:〖羊猪兔〗开兔38准

-

134期:〖羊马猪〗开羊22准

-

133期:〖牛马虎〗开牛04准

-

132期:〖猴鼠羊〗开羊22准

-

131期:〖羊狗猪〗开羊22准

-

130期:〖鼠虎马〗开马23准

-

002期:菜肉草肖(正在更新)开?00中

-

001期:菜肉草肖(肉肖草肖)开羊22中

-

140期:菜肉草肖(菜肖草肖)开兔14中

-

139期:菜肉草肖(肉肖菜肖)开猴45中

-

138期:菜肉草肖(菜肖草肖)开猪18中

-

137期:菜肉草肖(肉肖草肖)开羊10中

-

136期:菜肉草肖(草肖菜肖)开牛28中

-

135期:菜肉草肖(肉肖草肖)开兔38中

-

134期:菜肉草肖(草肖肉肖)开羊22中

-

133期:菜肉草肖(菜肖草肖)开牛04中

-

132期:菜肉草肖(草肖菜肖)开羊22中

-

131期:菜肉草肖(肉肖草肖)开羊22中

-

130期:菜肉草肖(草肖肉肖)开马23中

-

129期:菜肉草肖(草肖菜肖)开兔38中

-

128期:菜肉草肖(肉肖草肖)开龙01中

-

肉肖:虎蛇龙狗

菜肖:猪鼠鸡猴

草肖:牛羊马兔

-

002期:男女中特【正在】【更新】开猫00中

-

001期:男女中特【女肖】【女肖】开羊22中

-

140期:男女中特【女肖】【女肖】开兔14中

-

139期:男女中特【男肖】【男肖】开猴45中

-

138期:男女中特【女肖】【女肖】开猪18中

-

137期:男女中特【女肖】【女肖】开羊10中

-

136期:男女中特【男肖】【男肖】开牛28中

-

女肖:兔蛇羊鸡猪

男肖:鼠牛虎龙马猴狗

-

002期:六扇门平特(更新中)开00中

-

001期:六扇门平特(猴猴猴)开45中

-

140期:六扇门平特(龙龙龙)开01中

-

139期:六扇门平特(鼠鼠鼠)开41中

-

138期:六扇门平特(兔兔兔)开14中

-

137期:六扇门平特(虎虎虎)开03中

-

136期:六扇门平特(马马马)开11中

-

135期:六扇门平特(兔兔兔)开38中

-

002期:一行中特(金)防(木水土)开?00中

-

001期:一行中特(金)防(木火土)开羊22中

-

140期:一行中特(金)防(木水火)开兔14中

-

139期:一行中特(金)防(木火土)开猴45中

-

138期:一行中特(金)防(水火土)开猪18中

-

137期:一行中特(金)防(水火土)开羊10中

-

136期:一行中特(金)防(木水土)开牛28中

-

135期:一行中特(金)防(木水火)开兔38中

-

134期:一行中特(金)防(火木土)开羊22中

-

133期:一行中特(金)防(木土火)开牛04中

-

132期:一行中特(木)防(水火土)开羊22中

-

131期:一行中特(金)防(土水木)开羊22中

-

130期:一行中特(木)防(水火金)开马23中

-

129期:一行中特(金)防(火水木)开兔38中

-

128期:一行中特(金)防(水土火)开龙01中

-

127期:一行中特(金)防(水土火)开羊34中

-

126期:一行中特(土)防(水木金)开马35中

-

【金】:02 03 10 11 24 25 32 33 40 41

【木】:06 07 14 15 22 23 36 37 44 45

【水】:12 13 20 21 28 29 42 43

【火】:01 08 09 16 17 30 31 38 39 46 47

【土】:04 05 18 19 26 27 34 35 48 49

-

002期杀特三肖[更新中]开?00中

-

001期杀特三肖[牛兔龙]开羊22中

-

140期杀特三肖[鼠虎马]开兔14中

-

139期杀特三肖[牛蛇羊]开猴45中

-

138期杀特三肖[鼠龙羊]开猪18中

-

137期杀特三肖[兔蛇猴]开羊10中

-

136期杀特三肖[龙猴猪]开牛28中

-

135期杀特三肖[鼠鸡猴]开兔38中

-

134期杀特三肖[狗牛鸡]开羊22中

-

133期杀特三肖[鼠猴马]开牛04中

-

132期杀特三肖[兔龙虎]开羊22中

-

131期杀特三肖[猴虎牛]开羊22中

-

130期杀特三肖[鼠牛猪]开马23中

-

129期杀特三肖[猪鸡羊]开兔38中

-

128期杀特三肖[虎龙牛]开龙01中

-

127期杀特三肖[兔蛇鼠]开羊34中

-

126期杀特三肖[牛猴鸡]开马35中

-

125期杀特三肖[鸡马羊]开蛇12中

-

124期杀特三肖[鼠牛马]开鼠29中

-

123期杀特三肖[鸡猴龙]开马23中

-

122期杀特三肖[猴狗鸡]开猪30中

-

002期杀特三尾[更新中]开?00中

-

001期杀特三尾[158尾]开羊22中

-

140期杀特三尾[027尾]开兔14中

-

139期杀特三尾[237尾]开猴45中

-

138期杀特三尾[137尾]开猪18中

-

137期杀特三尾[357尾]开羊10中

-

136期杀特三尾[246尾]开牛28中

-

135期杀特三尾[157尾]开兔38中

-

134期杀特三尾[074尾]开羊22中

-

133期杀特三尾[018尾]开牛04中

-

132期杀特三尾[012尾]开羊22中

-

131期杀特三尾[048尾]开羊22中

-

130期杀特三尾[045尾]开马23中

-

129期杀特三尾[179尾]开兔38中

-

128期杀特三尾[024尾]开龙01中

-

127期杀特三尾[459尾]开羊34中

-

126期杀特三尾[349尾]开马35中

-

125期杀特三尾[035尾]开蛇12中

-

124期杀特三尾[467尾]开鼠29中

-

122期杀特半波[绿单]开猪30中

-

123期杀特半波[绿单]开马23中

-

124期杀特半波[蓝双]开鼠29中

-

125期杀特半波[绿单]开蛇12中

-

126期杀特半波[绿双]开马35中

-

127期杀特半波[红双]开羊34中

-

128期杀特半波[蓝双]开龙01中

-

129期杀特半波[蓝双]开兔38中

-

130期杀特半波[蓝单]开马23中

-

131期杀特半波[绿双]开羊22中

-

132期杀特半波[红双]开羊22中

-

133期杀特半波[红双]开牛04中

-

134期杀特半波[绿单]开羊22中

-

135期杀特半波[绿单]开兔38中

-

136期杀特半波[红双]开牛28中

-

137期杀特半波[绿单]开羊10中

-

138期杀特半波[蓝单]开猪18中

-

139期杀特半波[绿双]开猴45中

-

140期杀特半波[红单]开兔14中

-

001期杀特半波[蓝单]开羊22中

-

002期杀特半波[更新]开?00中

- 精品四不像

- 澳门挂牌

- 澳门跑狗图

- 九肖十码

- 女人味

- 美人鱼

- 澳门春宫圖

- 澳门跑马图

- 正版蛇蛋图

- 凤凰天机图

- 澳门傳眞

- 龙门客栈

- 男人味

- 澳门红虎

- 澳門内幕

- 相入非非

- 石獅镇碼

- 每日闲情

- 幽默猜测

- 功夫早茶

- 一句真言

- 周公解梦

- 趣味幽默

- 老版跑狗

- 特码诗句

- 另版跑狗

- 番薯真人

- 金钱豹A

- 澳彩签牌

- 值日生肖

- 通天报社

- 奥彩专用

- 奥客家娘

- 财神报A

- 银财神报

- 财神报B

- 金财神报

- 请财神报

- 蓝财神报

- 平财神报

- 财神报C

- 绿财神报

- 波贴天机

- 独解传真

- 澳门马票

- 金钱豹B

- 早茶论码

- 拾贰地支

- 妈祖显灵

- 六合神童

- 皇道吉日

- 澳门西游

- 玄机秘贴

- 正版射牌

- 平特一肖

- 凤凰卜卦

- 钟馗大神

- 正版诗象

- 心水彩报

- 青龙精解

- 宝马彩报

- 澳门日报

- 澳门信封

- 白狼经典

- 小幽默之

- 澳彩图库

- 秘典玄机

- 六合内幕

- 六合典家

- 财神特码

- 财童送宝

- 财童送码

- 内幕玄機

- 博彩特利

- 六合雄霸

- 龍騰豹變

- 内幕选馬

- 馬會追踪

- 馬會追踪

- 妈祖献宝

- 奇准无比

- 猪哥报

- 六合英雄

- 六合黑庄

- 急智金囊

- 香港挂牌

- 大富翁

- 神鸟版

- 发财献策

- 马经霸王

- 诸葛神算

- 发财波局

- 识破玄机

- 狗头报

- 蜗牛报

- 独一无二

- 会员料

- 玄学代码

- 五星报B

- 神算策略

- 大话特码

- 铁算盘

- 广东赌王

- 观音心经

- 六合飞鸽

- 藏宝图

- 精品报

- 天尊报

- 洋通报

- 特码图

- 天机报

- 内幕报

- 马会图

- 九龙密报

- 小贴士A

- 湖南码报

- 莲花报

- 九龙精解

- 三元神算

- 经典尾报

- 经典单双

- 不服来战

- 新大富翁

- 发财秘诀

- 红灯笼

- 码头诗

- 六合头条

- 蓝财神

- 电邮天地

- 女财神报

- 东南漫画

- 金元宝

- 赚客报

- 新粤彩4

- 天眼神算

- 香港挂牌

- 正手写A

- 白姐泄密

- 精锐报

- 一样发

- 五福临门

- 佛祖救世

- 内幕赌经

- 福星报

- 心水特码

- 孔明报

- 蛇报A

- 旺角菜报

- 三合皇

- 一封信

- 点将单

- 水果报

-

2024龙年(十二生肖号码对照)鼠

[冲马]

05172941牛[冲羊]

04162840虎[冲猴]

03152739兔[冲鸡]

02142638龙[冲狗]

0113253749蛇[冲猪]

12243648马[冲鼠]

11233547羊[冲牛]

10223446猴[冲虎]

09213345鸡[冲兔]

08203244狗[冲龙]

07193143猪[冲蛇]

06183042 -

玻色参照表红波:0102070812131819232429303435404546蓝波:03040910141520252631363741424748绿波:05061116172122272832333839434449

-

五行参照表金:02031011242532334041木:06071415222336374445水:1213202128294243火:0108091617303138394647土:04051819262734354849

-

合数单双合数单:01030507091012141618212325272930323436384143454749合数双:020406081113151719202224262831333537394042444648

-

生肖属性照表家禽:牛、马、羊、鸡、狗、猪野兽:鼠、虎、兔、龙、蛇、猴吉美:兔、龙、蛇、马、羊、鸡凶丑:鼠、牛、虎、猴、狗、猪阴性:鼠、龙、蛇、马、狗、猪阳性:牛、虎、兔、羊、猴、鸡单笔:鼠、龙、马、蛇、鸡、猪双笔:虎、猴、狗、兔、羊、牛天肖:兔、马、猴、猪、牛、龙地肖:蛇、羊、鸡、狗、鼠、虎白边:鼠、牛、虎、鸡、狗、猪黑中:兔、龙、蛇、马、羊、猴女肖:兔、蛇、羊、鸡、猪(五宫肖)男肖:鼠、牛、虎、龙、马、猴、狗三合:鼠龙猴、牛蛇鸡、虎马狗、兔羊猪六合:鼠牛、龙鸡、虎猪、蛇猴、兔狗、马羊琴:兔蛇鸡棋:鼠牛狗书:虎龙马画:羊猴猪五福肖::鼠、虎、兔、蛇、猴[龙]红肖:马、兔、鼠、鸡蓝肖:蛇、虎、猪、猴绿肖:羊、龙、牛、狗